estate tax changes in 2025

The estate tax due would be zero. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025.

Federal Tax Cuts In The Bush Obama And Trump Years Itep

We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable.

. That means individuals this year can pass on tax-free 114 million from their estate and gifts they gave before their death. This is the amount one person can pass gift and estate tax free during their life or upon death. With inflation adjustments the exemption is 117 million in 2021.

A separate annual gift exclusion for each donee is set at 15000 in 2021 The estate tax exemption was set at 5 million in 2011 adjusted for inflation. The estate tax changes that were anticipated in the final months of 2021 are apparently not materializing leaving some people scratching their heads as to what they should do next. The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025.

This exemption decreased the number of individuals whod. What is the 2025 Tax Sunset. Instead the exemption would expire at the end of 2021 and beginning in 2022 the Federal Estate Tax will be reduced to 5 million.

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. If this occurs and his plans to reduce the exemption to 3500000 with an increased maximum tax rate of 45 are passed it could add an additional 1410000 in Estate Tax assessments meaning 3690000 would be due nine months after the date of death on an estate of 11700000 and it could be effective long before the December 31 2025 Sunset date. Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025 says that the exemption increase was a big priority for Republicans in the 2017 tax overhaul.

A certain amount of each estate 5 million in 2011 indexed for inflation is exempted from taxation by the federal government. At a tax rate of 40 thats a 72 million tax bill. This increase expires after 2025.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Couples can pass on 228 million. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions.

Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to. Transfers certain estate tax costs and the exemption. But Estate Tax Changes May Be Ahead Dont forget that these estate tax amounts are expected to reset or sunset after 2025 when the new higher limits expire per Congressional direction and drop back to pre-2018 levels that will mean a drop closer to 5 million.

If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Estate Tax Exclusion Change Now and in 2025.

The Exemption Can Decrease After 2025. WASHINGTON Today the IRS announced that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. If HNW had instead gifted the maximum 234 million now under the current exemption their taxable estate would be only 66 million resulting in a tax bill of 2520000 a savings of nearly 5.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. While nothing is currently set to expire in 2024 December 31st 2025 will be a significant day for most taxpayers. This will reduce the number of people subject to the estate tax as well as reducing the amount of estate tax paid by those still subject to it.

With proper trust provisions. The exemption will increase with inflation to approximately 12060000 per person in 2022. Under TCJA the estate tax exclusion was doubled to 112 million per person in 2018.

They could use the 5 million estate exemption at the 35 estate tax rate or they could elect to use the 0 estate tax exemption at a 0 tax rate coupling the use of modified carryover basis rules. For example corporations are happier with the lower. However this change is set to expire after December 31 2025.

Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted for. With inflation this may land somewhere around 6 million.

President Trump signed the Tax Cuts and Jobs Act TCJA into law on December 22 2017 which brought many changes to the Internal Revenue Code IRC. Because the exclusion amount is back to 115 million your estate tax is 46 million. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information.

The estate tax exclusion has increased to 1206 million. In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. With indexation the value was 549 million in 2017 and with the temporary.

Specifically the Federal Estate Tax Exemption would not expire at the end of 2025. The changes made have affected many taxpayers in different ways. Twenty-three provisions from the Tax Cuts and Jobs Act directly relating to individual income taxes will expire meaning most taxpayers will see a tax hike unless some or all provisions are extended.

The Treasury Department and the IRS issued proposed regulations which implement. The bill introduced by the House Ways Means Committee is attempting to change this and roll back the 2017 Trump Tax Cuts. The TCJA doubled that exemption for 2018-2025.

At a tax rate of 40 thats a 72 million tax bill. The estate tax is imposed on bequests at death as well as inter-vivos during life gifts.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

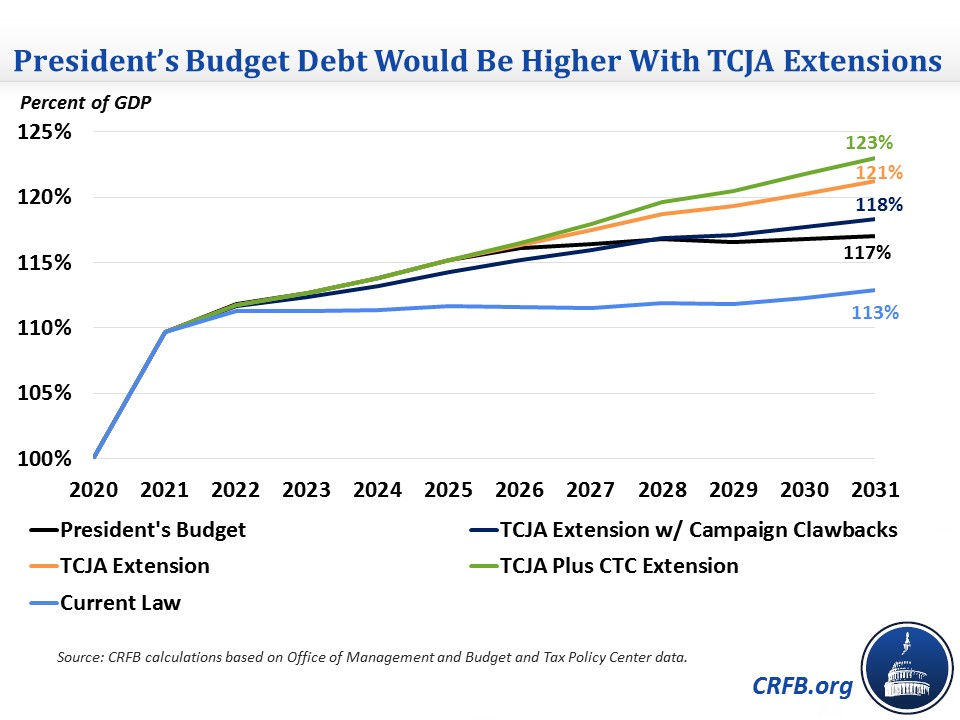

President S Budget Would Add More To Debt With Tax Cut Extensions Committee For A Responsible Federal Budget

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

2020 Estate Planning Update Helsell Fetterman

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Federal Tax Cuts In The Bush Obama And Trump Years Itep

How Did The Tcja Change The Amt Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)